Grounds For Judicial Divorce Grounds on which a woman may seek khula include:

- Grounds For Judicial Divorce

Grounds on which a woman may seek khula include: - Desertion by husband for four years,

Failure to maintain for two years Husband contracting a polygamous marriage in contravention of established legal procedures

Husband contracting a polygamous marriage in contravention of established legal procedures

Husband’s imprisonment for seven years,

Husband’s failure to perform marital obligations for three years,

Husband’s continued impotence from the time of the marriage,

Husband’s insanity for two years or his serious illness,

Wife’s exercise of her option of puberty if she was contracted into marriage by any guardian before age of 16 and repudiates the marriage before the age of 18 (as long as the marriage was not consummated), - Husband’s crauelty (including physical or another mistreatment, unequal treatment of co-wives), and

- Any other ground recognized as valid for the dissolution of marriage under Muslim law.

Ali & Haseeb Law Associates

- Our Law firm is providing legal services regarding family laws of Pakistan including divorce, khula, domestic violence, child custody, child support, separatio

n agreements, compensation and maintenance, adoption, visitation, and other related legal issues.

n agreements, compensation and maintenance, adoption, visitation, and other related legal issues.

& , a multidimensional and renowned Law firm rendering legal services in diversified fields including Corporate, Commercial, Banking, Tax, Civil, Family and other fields of law.

We are also providing legal consultancy online.

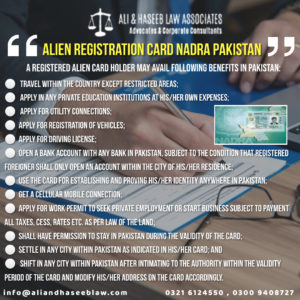

Alien Registration Card NADRA Pakistan

- A registered alien card holder may avail following benefits in Pakistan

- Travel within the country except restricted areas;

- apply in any private education institutions at his/her own expenses;

- apply for utility connections;

- apply for registration of vehicles;

- apply for driving license;

- open a bank account with any bank in Pakistan, subject to the condition that registered foreigner shall only open an account within the city of his/her residence;

- use the card for establishing and proving his/her identity anywhere in Pakistan;

- get a cellular mobile connection;

- apply for work permit to seek private employment or start business subject to payment all taxes, cess, rates etc. as per law of the land;

- shall have permission to stay in Pakistan during the validity of the card;

- settle in any city within Pakistan as indicated in his/her card; and

- shift in any city within Pakistan after intimating to the Authority within the validity period of the card and modify his/her address on the card accordingly.

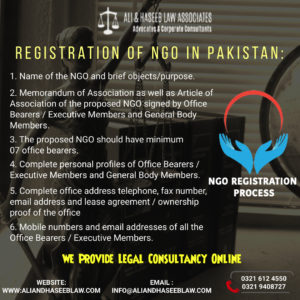

REGISTRATION OF NGO IN PAKISTAN

- Registration of NGO in Pakistan:

- 1. Name of the NGO and brief objects/purpose.

- 2. Memorandum of Association as well as Article of Association of the proposed NGO signed by Office Bearers / Executive Members and General Body Members.

- 3. The proposed NGO should have minimum 07 office bearers.

- 4. Complete personal profiles of Office Bearers / Executive Members and General Body Members.

- 5. Complete office address telephone, fax number, email address and lease agreement / ownership proof of the office

- 6. Mobile numbers and email addresses of all the Office Bearers / Executive Members.

- Contact us for registration of NGO in Pakistan

LAW OF DIVORCE IN PAKISTAN

- Law of Divorce In Pakistan

- A divorce may be affected in the following ways:

- • By the husband at his will; or

- • By mutual consent of the husband and the wife; or

- • By a judicial decree at the instance of the husband or the wife.

CONSUMER PROTECTION LAW IN PAKISTAN

-

CONSUMER LAW PRACTICE IN PAKISTAN

-

The law provides for establishing consumer dispute redressed machinery at the district level.

-

It applies to all goods and services.

-

It covers all sectors, whether private, public or any individual person.

-

Doctrines of “Privity of Contract” and “Caveat Emptor” has not been covered under these Acts.

WHITE COLLAR CRIME IN PAKISTAN

-

White collar crime essentially means the crime committed by higher class of society by individual or group during their course of occupation.

-

Usually such employees enjoy a worthy designation in business and use such position to usurp and embezzle in a business transaction.

-

Money Laundering, Cyber Crime including cyber hacking, business frauds, Document Fraud and Forgery, dishonest Issuance of cheque are some of the key examples of White Collar Crime in Pakistan.

CITIZENSHIP & RESIDENCY

- CITIZENSHIP & RESIDENCY Citizenship & Residency by Investment (CBI) is a legal

process that allows the individuals and their families.

process that allows the individuals and their families. - You can have the second citizenship in exchange of a monetary contribution to the economy of other country.

- Every country has different slabs of rates of investment for individuals and family consisting of number of defendants, below 30 years of age. Our approval rate is up to 99%, therefore there will be no uncertainty and you will be able to secure your family’s future.

WHAT ARE THE DIFFERENT INTERNATIONAL TRADEMARK TREATIES SIGNED BY PAKISTAN?

-

Pakistan has signed several international treaties for the enforcement of rights of local and foreign proprietors of different Trademark including:

-

The Convention Establishing the World Intellectual Property Organization;

-

The Paris Convention for the Protection of Industrial Property 1883 (Paris Convention);

-

The Agreement establishing the World Trade Organization (WTO).

-

The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS); and

-

Madrid Agreement since February 2021 to centrally administer trademark regulations

Copyright Protection in Pakistan

-

copyright attorneys have extensive experience in helping clients file

for copyright protection, and work proactively to identify ownership issues before they arise.

for copyright protection, and work proactively to identify ownership issues before they arise. -

In addition to counseling our clients on the registration of original works of authorship, we can assist them in establishing systems for policing and enforcing their copyrights.

MORTGAGE LICENSING FOR BANKS, LENDERS AND BROKERS

-

Ali and Haseeb Law Associates provides nationwide mortgage licensing expertise for banks, lenders and brokers.

SERVICES PROVIDEDConsultation regarding licensing requirements;Certificate of Authority filings;Assumed Business name (DBA) filings;Registered agent registrations;Nationwide mortgage lender and mortgage broker licensing filings;License renewals;Consultation concerning state requirements on advertising, disclosures, late fees and prepayment penalties;Audit assistance;Ongoing compliance solutions;Expand your lending or brokering territory into new states;Focus on your business while we handle your licensing and regulatory requirements; andMore affordable than using or hiring your own staff

SERVICES PROVIDEDConsultation regarding licensing requirements;Certificate of Authority filings;Assumed Business name (DBA) filings;Registered agent registrations;Nationwide mortgage lender and mortgage broker licensing filings;License renewals;Consultation concerning state requirements on advertising, disclosures, late fees and prepayment penalties;Audit assistance;Ongoing compliance solutions;Expand your lending or brokering territory into new states;Focus on your business while we handle your licensing and regulatory requirements; andMore affordable than using or hiring your own staff

Registration of Partnership Firm or Registration of Joint Venture Company

- Ali and Haseeb Law Associates can assist our clients in registration

of Partnership Firm before the concerned registrar of Firms. It is important that our clients furnish the following information:

of Partnership Firm before the concerned registrar of Firms. It is important that our clients furnish the following information: - First Name

- Place or principle place of business of the firm.

- Names of any other places where the firm carries on business.

- Date when each partner joined the firm.

- Names in full and permanent addresses of the partners.

- Duration of the firm.

Protection and Promotion of PWDs’ Rights.

-

The Disabled Persons (Employment and Rehabilitation) Ordinance, 1981” laid formal

foundation for institutional care of the persons with disabilities.

foundation for institutional care of the persons with disabilities. -

The Ordinance ensuresprotection of PWDs’ rights related to education, employment, rehabilitation and emphasizes tocreate Funds and establish the National Council for the Rehabilitation of Disabled Persons

DIFFERENCE BETWEEN LEASE AND LICENCE

-

A licence confers a right to do or continue to do something in or upon immovable property

of grantor which but for the grant of the right may be unlawful, but it creates no estate or interest in the immovable property of the grantor.A lease on the other hand creates an interest in the property demised.

of grantor which but for the grant of the right may be unlawful, but it creates no estate or interest in the immovable property of the grantor.A lease on the other hand creates an interest in the property demised.

WHAT IS PROVIDENT FUND?

- Provident fund is a very common retirement plan to benefit the employees, which is

contributory in nature and yields a feeling of participation in employees.

contributory in nature and yields a feeling of participation in employees. - The establishment settles the provident fund in form of Trust, required to be registered with the concerned sub-registrar for getting the status of an independent bod

Types of Provident Fund

- There are three types of provident fund, which are known as; Statutory Provident Fund:

Which are set up under the Provident Fund Act, 1925 and is maintained by Government, semi-government organizations, local authorities and other such institutions.

Which are set up under the Provident Fund Act, 1925 and is maintained by Government, semi-government organizations, local authorities and other such institutions. - Payments from such funds does not need recognitions from the Commissioner Inland Revenue and are exempted from tax. Recognized Provident Fund: Which is recognized by Commissioner Inland Revenue under the sixth schedule of the Income Tax Ordinance, 2001.

- This type of Provident fund is maintained by private sector or organizations. Payments from such provident funds are exempted from Income Tax.

- Unrecognized Provident Fund: No exemptions are available but there is no yearly taxability. Employer’s Contributions and interest thereon will be taxable at the time of payments to the employees only

AMENDING YOUR INCOME TAX RETURN & HOW IT WORKS

- AMENDING YOUR INCOME TAX RETURN & HOW IT WORKS

- For almost any kind of error, know that it is fixable. You can file a revised return there are two possibilities:

- 1. You need to apply for revision and must request a commissioner to allow you a correction, describe the reason for revision along with documentary evidence of errors (if any)

- 2. Second, if your correction leads to higher income, there is no need to write a revision application to the commissioner. Simply revise your tax return.

LAWS AND REGULATIONS TO REGISTER NGO IN PAKISTAN

-

LAWS AND REGULATIONS TO REGISTER NGO IN PAKISTAN

The laws regulating the business and framework of NGO and its registration is different from entity that works for profit in Pakistan. NGO can be registered under different’s law and can function in consonance to the different set of provisions provided for in those laws. Different laws under which NGO can be registered in Pakistan are as follow:1. The Companies Act, 20172. The Voluntary Social Welfare Agencies (Registration & Control) Ordinance, 19613. The Societies Registration Act, 18604. The Trust Act, 1882

The laws regulating the business and framework of NGO and its registration is different from entity that works for profit in Pakistan. NGO can be registered under different’s law and can function in consonance to the different set of provisions provided for in those laws. Different laws under which NGO can be registered in Pakistan are as follow:1. The Companies Act, 20172. The Voluntary Social Welfare Agencies (Registration & Control) Ordinance, 19613. The Societies Registration Act, 18604. The Trust Act, 1882

DOCUMENTS REQUIRED FOR NGO REGISTRATION UNDER SOCIETIES ACT 1860

-

DOCUMENTS REQUIRED FOR NGO REGISTRATION UNDER SOCIETIES ACT 1860

• The Memorandum of Association• The Articles of Association• Attested Cnic copies of all members of organization• The 1st minute of meeting of Members of Society• Registered address, Correspondence email address, Correspondence telephone and website address of Society.• Application for registration must be given on Letterhead accompanied by prescribed forms available at office of Registrar Societies.• The office bearers list with mobile number signed by each office bearer• Members list of Society along with contact numbers, valid email addressess of all members• Property papers or lease agreement of the office premises

• The Memorandum of Association• The Articles of Association• Attested Cnic copies of all members of organization• The 1st minute of meeting of Members of Society• Registered address, Correspondence email address, Correspondence telephone and website address of Society.• Application for registration must be given on Letterhead accompanied by prescribed forms available at office of Registrar Societies.• The office bearers list with mobile number signed by each office bearer• Members list of Society along with contact numbers, valid email addressess of all members• Property papers or lease agreement of the office premises

DOCUMENT REQUIRED FOR NGO REGISTRATION UNDER THE TRUST ACT, 1882

- DOCUMENT REQUIRED FOR NGO REGISTRATION UNDER THE TRUST ACT, 1882

When Gratuity becomes payable?

- When Gratuity becomes payable?

- The gratuity fund is to be paying at the end of the service term if:

- The employee has resigned.

- The employer has sacked the employee on any grounds apart from misconduct.

- (If the worker is found guilty of misbehaving and violation of Code of Conduct, then the employer is not compelled to pay any Gratuity).

- The employee has expired.

- The employee has retired or is eligible for superannuation.

Process of registering a patent

- Process of registering a patent

Due Diligence in Pakistan

- Legal due diligence seeks to examine the legal basis of a transaction,

for example to ensure that a target business holds or can exercise the intellectual property rights that are crucial to the future success of the company.

for example to ensure that a target business holds or can exercise the intellectual property rights that are crucial to the future success of the company.

What is Cyber Harassment?

- What is Cyber Harassment?

- Cyber–harassment usually pertains to unconsented conduct, such as threatening or harassing email/instant messages, or to blog entries or websites dedicated solely to tormenting an individual.

- Harassment does not include constitutionally protected activity or conduct that serves a legitimate purpose, i.e., free speech.

What is Cyber Stalking?

- What is Cyber Stalking?

- Cyber Stalking: the use of the Internet, email, or other electronic communications to stalk; generally refers

to a pattern of threatening or malicious behaviors, including communicating a credible threat of harm.

to a pattern of threatening or malicious behaviors, including communicating a credible threat of harm.

Income Tax Refund in Pakistan

- For the Income Tax, there is a provision of Section 170 of the Income

Tax Ordinance 2001 which allows the tax payer, who has paid tax in excess of the amount which the taxpayer is properly chargeable under the Ordinance may apply to the Commissioner for the refund of the excess amount.

Tax Ordinance 2001 which allows the tax payer, who has paid tax in excess of the amount which the taxpayer is properly chargeable under the Ordinance may apply to the Commissioner for the refund of the excess amount.

Income Tax Returns in Pakistan

- Income tax returns are the forms in which assessees file information

abouttheir Income and tax thereon before the Income Tax Department. If anyone files a belated return, he / she would not allowed to carry forward certain losses.

abouttheir Income and tax thereon before the Income Tax Department. If anyone files a belated return, he / she would not allowed to carry forward certain losses. - The result of all this is that you’re required to file a tax return every year. Through this process, it’s determined whether you owe additional taxes beyond what you’ve already paid to the federal government, or if you’re owed a refund of the taxes you’ve already paid.

Consumer Law in Pakistan

The law provides for establishing consumer dispute redressed machinery at the

district level.

Legal Age Of Child Custody After Divorce

Legal Age Of Child Custody After Divorce

Ali and Haseeb Law Associates are recognized experts who provide advice for residency and citizenship by investment to our clients.

and citizenship by investment to our clients. You can have the best suited advice from us. In this way, you can secure your family’s future and may avail more personal freedom of mobility. Residency can give you the right to live in a country and conduct business, while citizenship may give you the rights as any other citizen of that country may have. You can give the right of citizenship to your children

and citizenship by investment to our clients. You can have the best suited advice from us. In this way, you can secure your family’s future and may avail more personal freedom of mobility. Residency can give you the right to live in a country and conduct business, while citizenship may give you the rights as any other citizen of that country may have. You can give the right of citizenship to your childrenWhat is Geographical Indication?

The definition of ‘geographical indication’ covers agricultural goods, natural goods or  manufactured or produced goods of a particular territory, region or locality of certain quality, reputation or other characteristic of the goods or ingredients or components essentially attributable to its geographical origin. Further, GIs for manufactured goods cover activities relating to the production, processing or preparation of the goods in a specific territory.

manufactured or produced goods of a particular territory, region or locality of certain quality, reputation or other characteristic of the goods or ingredients or components essentially attributable to its geographical origin. Further, GIs for manufactured goods cover activities relating to the production, processing or preparation of the goods in a specific territory.

Geographical indications (GIs) are marks, signs or symbols which indicate that the associated goods:

Labour Law in Pakistan:

Labour Law in Pakistan is very comprehensive and contains several Ordinances, Acts, Rules & Regulations and all other statutes relating to Industrial, Commercial and Labour Establishments which are widely scattered and inaccessible statutes. Our Law Firm has the main object to provide the legal services concerning these Labour Laws to the Employers and the Employees for the smooth running of the business in order to achieve the target of higher productively, reasonable profits and better wages.

Debt Recovery In Pakistan

companies or organisations. An organisation that specialises in recovery of debt is called a collection agency or debt collector.

companies or organisations. An organisation that specialises in recovery of debt is called a collection agency or debt collector.Modaraba Company Pakistan

Modaraba or Mudarabah is a special kind of partnership where one partner gives money to  another for investing it in a commercial enterprise. The investment comes from the first partner who is called “rabb-ul-mal”, while the management and work is an exclusive responsibility of the other, who is called “mudarib” and the profits generated are shared in a predetermined ratio.

another for investing it in a commercial enterprise. The investment comes from the first partner who is called “rabb-ul-mal”, while the management and work is an exclusive responsibility of the other, who is called “mudarib” and the profits generated are shared in a predetermined ratio.

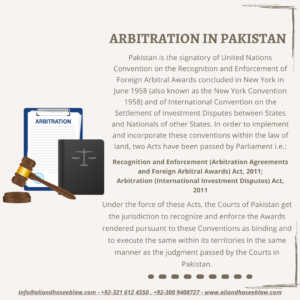

Arbitration In Pakistan

Enforcement of Foreign Arbitral Awards concluded in New York in June 1958 (also known as the New York Convention 1958) and of International Convention on the Settlement of Investment Disputes between States and Nationals of other States. In order to implement and incorporate these conventions within the law of land, two Acts have been passed by Parliament i.e.:

Enforcement of Foreign Arbitral Awards concluded in New York in June 1958 (also known as the New York Convention 1958) and of International Convention on the Settlement of Investment Disputes between States and Nationals of other States. In order to implement and incorporate these conventions within the law of land, two Acts have been passed by Parliament i.e.:

DISTINCTION BETWEEN INDIRECT AND DIRECT TAXES

Direct taxes are the kind of taxes whose burden is borne by the person on whom the tax is  levied while indirect taxes are the kind of taxes the burden of which is always born by the end consumers and not the seller/importer of the supply (the entities on whom the tax is levied). The distinction between the two is laid down and guarded by the statutes and any shift of burden from the purchaser to the manufacturer or vice versa is deemed to be unlawful and is guarded by the statutes.

levied while indirect taxes are the kind of taxes the burden of which is always born by the end consumers and not the seller/importer of the supply (the entities on whom the tax is levied). The distinction between the two is laid down and guarded by the statutes and any shift of burden from the purchaser to the manufacturer or vice versa is deemed to be unlawful and is guarded by the statutes.

BROKERAGE COMPANY

Brokerage company’s prime role is to act as a middleman that connects buyers and sellers for facilitating a business trans action. Brokerage companies typically receive compensation by means of commissions or fees that are charged once the transaction has been made successfully. In these days, the compensation might be paid by the exchange or by the customer, or in some cases both.

action. Brokerage companies typically receive compensation by means of commissions or fees that are charged once the transaction has been made successfully. In these days, the compensation might be paid by the exchange or by the customer, or in some cases both.

BUSINESS TAX PLANNING

Ali & Haseeb Law Associates tax practice brings with it over decades of experience in dealing with the complexities of Pakistan’s Taxation system. Our tax experts are adept at finding answers to business problems across varied sectors, as well as objectively analysing solutions proposed by others.

in dealing with the complexities of Pakistan’s Taxation system. Our tax experts are adept at finding answers to business problems across varied sectors, as well as objectively analysing solutions proposed by others.

NPO & NGO REGISTRATION IN PAKISTAN

Ali & Haseeb Law Associates provides comprehensive legal services to non-profit  organizations and associations in the Islamic Republic of Pakistan. We provide services to businesses, institutions, educational, social, religious, individuals and families seeking to accomplish non-profit objectives. In Pakistan there are numbers of laws for registration of non-profit organizations including the prominent Acts and Ordinances as The Societies Registration Act, 1860, The Trusts Act, 1882, Registration of non-profit Companies under section 42 of the Companies Ordinance, 1984, The Co-operative Societies Act, 1925, Trade Organisations Ordinance, 2007, Non-Profit Public Benefit Organisations (Governance and Support) Act, 2003, Mussalman Waqf Act, 1923, Charitable Endowments Act, 1923.

organizations and associations in the Islamic Republic of Pakistan. We provide services to businesses, institutions, educational, social, religious, individuals and families seeking to accomplish non-profit objectives. In Pakistan there are numbers of laws for registration of non-profit organizations including the prominent Acts and Ordinances as The Societies Registration Act, 1860, The Trusts Act, 1882, Registration of non-profit Companies under section 42 of the Companies Ordinance, 1984, The Co-operative Societies Act, 1925, Trade Organisations Ordinance, 2007, Non-Profit Public Benefit Organisations (Governance and Support) Act, 2003, Mussalman Waqf Act, 1923, Charitable Endowments Act, 1923.

Which courts or other bodies have judicial oversight or supervision of

The Arbitral Process?

Arbitration under the 1940 Act is conducted under the judicial oversi and supervision of the  ‘civil courts’. Under section 2(c) of the 1940 Act a civil court is taken to mean a civil court having jurisdiction to decide the Question forming the subject matter of the reference if the same had been the subject matter of a suit.

‘civil courts’. Under section 2(c) of the 1940 Act a civil court is taken to mean a civil court having jurisdiction to decide the Question forming the subject matter of the reference if the same had been the subject matter of a suit.

Are there any mandatory laws (of the seat or elsewhere) which will apply?

The law applicable to arbitration proceedings is normally the law of the arbitration agreement, as agreed by the parties. The courts have held that where the law of the main contract is Pakistani law but the arbitration is taking place outside Pakistan, it is the law of the seat of the arbitration that governs the procedure and the proceedings of a foreign arbitration and Pakistani courts would not exercise any jurisdiction in this respect.

as agreed by the parties. The courts have held that where the law of the main contract is Pakistani law but the arbitration is taking place outside Pakistan, it is the law of the seat of the arbitration that governs the procedure and the proceedings of a foreign arbitration and Pakistani courts would not exercise any jurisdiction in this respect.

What Steps Does the Arbitration Process Involve?

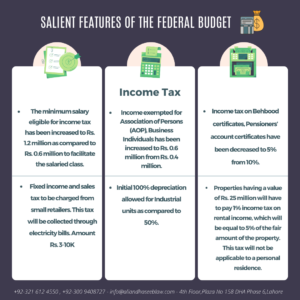

Salient Features of the Federal Budget 💰

- Income Tax

- The minimum salary eligible for income tax has been increased to Rs. 1.2 million as compared to Rs. 0.6 million to facilitate the salaried class.

- Income exempted for Association of Persons (AOP), Business Individuals has been increased to Rs. 0.6 million from Rs. 0.4 million

- Income tax on Behbood certificates, Pensioners’ account certificates have been decreased to 5% from 10%.

- Fixed income and sales tax to be charged from small retailers. This tax will be collected through electricity bills. Amount Rs. 3-10K.

- Initial 100% depreciation allowed for Industrial units as compared to 50%.

- Properties having a value of Rs. 25 million will have to pay 1% income tax on rental income, which will be equal to 5% of the fair amount of the property. This tax will not be applicable to a personal residence.

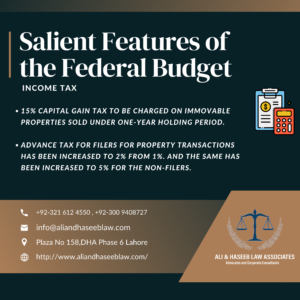

Salient Features of the Federal Budget 💰

period.

period.Salient Features of the Federal Budget 💰

Salient Features of the Federal Budget 💰

Benefits of ADR

esolution derive from their versatility and independence from court bureaucracy. The general concept of ADR has gained wide support among legislatures and courts. Successful ADR programs ensure neutrality, provide a forum for mutual education and encourage the parties themselves, not just their lawyers, to join in the negotiating process. In some instances, ADR may afford quicker resolutions and lower costs than conventional court proceedings.

esolution derive from their versatility and independence from court bureaucracy. The general concept of ADR has gained wide support among legislatures and courts. Successful ADR programs ensure neutrality, provide a forum for mutual education and encourage the parties themselves, not just their lawyers, to join in the negotiating process. In some instances, ADR may afford quicker resolutions and lower costs than conventional court proceedings.Environmental Law In Pakistan

environment. A co-related but diverse set of regulatory managements, now strongly inclined by environmental legal principles, focus on the administration of specific natural resources, such as forests, minerals, or fisheries.

environment. A co-related but diverse set of regulatory managements, now strongly inclined by environmental legal principles, focus on the administration of specific natural resources, such as forests, minerals, or fisheries.Mediation Services in Family Matters

amicably to save time and avoid a court battle, Our Mediation Lawyer is the ideal choice for resolving clients’ problems amicably, offering mediation management for civil, criminal, family, and commercial matters.

amicably to save time and avoid a court battle, Our Mediation Lawyer is the ideal choice for resolving clients’ problems amicably, offering mediation management for civil, criminal, family, and commercial matters.Structure of the Mediation process in Pakistan

planning the process by the mediator are to establish basic contact, sign the mediation agreement, guide and assist the parties in their preparation and agree on the dates of the mediation sessions.

planning the process by the mediator are to establish basic contact, sign the mediation agreement, guide and assist the parties in their preparation and agree on the dates of the mediation sessions.

WHO IS A SECURITIES BROKER?

markets, they connect the buyer with the seller. Securities brokers sell or buy stocks, bonds, and other securities on the behalf of their customers. Securities brokers usually explains the available securities services to the potential clients and give advice on the purchase or sale of particular securities. They are responsible for Monitoring the financial markets and the performance of individual securities.

markets, they connect the buyer with the seller. Securities brokers sell or buy stocks, bonds, and other securities on the behalf of their customers. Securities brokers usually explains the available securities services to the potential clients and give advice on the purchase or sale of particular securities. They are responsible for Monitoring the financial markets and the performance of individual securities.WHO IS A SECURITIES BROKER?

markets, they connect the buyer with the seller. Securities brokers sell or buy stocks, bonds, and other securities on the behalf of their customers. Securities brokers usually explains the available securities services to the potential clients and give advice on the purchase or sale of particular securities. They are responsible for Monitoring the financial markets and the performance of individual securities.

markets, they connect the buyer with the seller. Securities brokers sell or buy stocks, bonds, and other securities on the behalf of their customers. Securities brokers usually explains the available securities services to the potential clients and give advice on the purchase or sale of particular securities. They are responsible for Monitoring the financial markets and the performance of individual securities.